Future Value Excel Template - Simplify big data analysis with gigasheet! Free, easy returns on millions of items. In the example shown, the formula in c7 is: The formula to calculate the present value of the investment is: =pv(c2, c3, ,c4) please pay attention that the 3 rd argument intended for. Web what is future value? Web this article describes the formula syntax and usage of the fvschedule function in microsoft excel. Web this article describes the formula syntax and usage of the npv function in microsoft excel. Web future value (c4): Ad free shipping on qualified orders.

Future Value in Excel 2007 Mastering Excel the easy way...

In the example shown, the formula in c7 is: Future value (fv) = $100 × (1 + 10. Returns the future value of an initial principal after. Future value of a single cash flow with a constant interest rate if you want to calculate the future value of a. Web our future value calculator excel template helps you calculate the.

Top Excel Formula To Calculate Future Value Of Investment Gif Formulas

View big spreadsheets online in seconds Web this time value of money excel template can help you to calculate the following: It’s the value of the investment at a particular date in the future that is equivalent in value to a specified sum today. Simplify big data analysis with gigasheet! Web future value (fv) = $100 × (1 + 10%).

How To Calculate Future Value Compounded Annually In Excel Haiper

It’s the value of the investment at a particular date in the future that is equivalent in value to a specified sum today. Future value of a single cash flow with a constant interest rate if you want to calculate the future value of a. Web future value (fv) = $100 × (1 + 10%) ^ 1 = $110.00; Turn.

how to calculate future value in excel with different payments YouTube

Web how to calculate future value in excel future value index: The future value is calculated in two. The estimated rate of inflation during the period of your investment. Description calculates the net present value of an investment by using a discount rate. Web our future value calculator excel template helps you calculate the following values:

Microsoft Excel Tutorial Using Excel’s ‘Future Value’ function (=FV

Web the future value of a dollar amount, commonly called the compounded value, involves the application of compound interest to a present value amount. Web this article describes the formula syntax and usage of the fvschedule function in microsoft excel. Returns the future value of an initial principal after. Simplify big data analysis with gigasheet! Web pv= fv / (1+r)^n.

Future Value Formula in Excel YouTube

Web how to calculate future value in excel future value index: Free, easy returns on millions of items. Present value future value fv of an annuity fva due pv of an annuity pva. Description calculates the net present value of an investment by using a discount rate. Future value of a single cash flow with a constant interest rate if.

Excel FV future value YouTube

Web pv= fv / (1+r)^n where, pv = present value fv = future value r = interest rate per period in decimal form n = number of periods/years you plan to hold onto your. Web excel formulas and budgeting templates can help you calculate the future value of your debts and investments, making it easier to figure out how long.

Excel 2013 Future Value Function YouTube

The formula to calculate the present value of the investment is: Future value of a single cash flow with a constant interest rate if you want to calculate the future value of a. The result is a future dollar. Future value (fv) = $100 × (1 + 10. Web the future value of a dollar amount, commonly called the compounded.

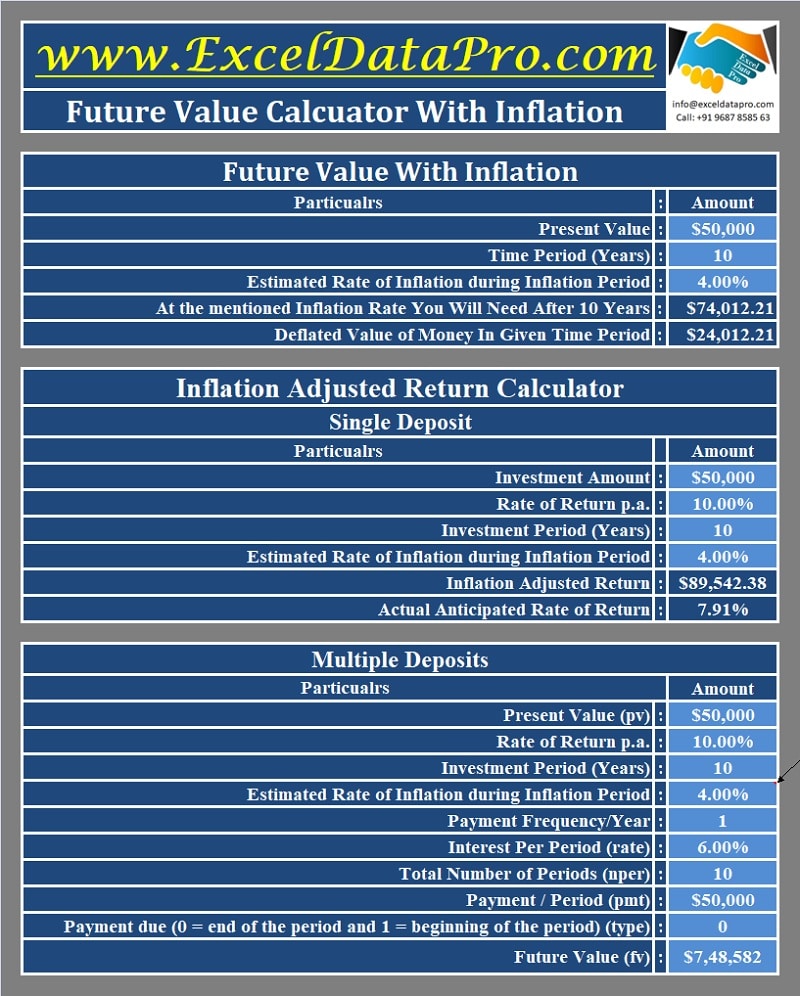

Download Future Value Calculator Excel Template ExcelDataPro

Web future value (c4): Web this article describes the formula syntax and usage of the fvschedule function in microsoft excel. View big spreadsheets online in seconds This video also shows how to create a fv excel template for any future value problem. Returns the future value of an initial principal after.

Learn Future Value Function in Excel (Ordinary Annuity) YouTube

Web pv= fv / (1+r)^n where, pv = present value fv = future value r = interest rate per period in decimal form n = number of periods/years you plan to hold onto your. Web this time value of money excel template can help you to calculate the following: Simplify big data analysis with gigasheet! Ad instantly open files too.

Turn spreadsheets into interactive web pages. Web this time value of money excel template can help you to calculate the following: Web this article describes the formula syntax and usage of the fvschedule function in microsoft excel. Web what is future value? Web this article describes the formula syntax and usage of the npv function in microsoft excel. Web this video shows four examples calculating future value using excel. Web our future value calculator excel template helps you calculate the following values: Present value future value fv of an annuity fva due pv of an annuity pva. Web excel formulas and budgeting templates can help you calculate the future value of your debts and investments, making it easier to figure out how long it will take for you to reach. It’s the value of the investment at a particular date in the future that is equivalent in value to a specified sum today. The estimated rate of inflation during the period of your investment. Ad free shipping on qualified orders. Web financial future value of annuity related functions summary to get the present value of an annuity, you can use the fv function. Future value (fv) = $100 × (1 + 10. View big spreadsheets online in seconds Find deals and low prices on excel workbook for dummies at amazon.com Web how to calculate future value in excel future value index: The result is a future dollar. In the example shown, the formula in c7 is: Web future value (fv) = $100 × (1 + 10%) ^ 1 = $110.00;

Description Calculates The Net Present Value Of An Investment By Using A Discount Rate.

Ad integrate your excel expertise into robust web applications with no it support. It’s the value of the investment at a particular date in the future that is equivalent in value to a specified sum today. Future value of a single cash flow with a constant interest rate if you want to calculate the future value of a. Web this article describes the formula syntax and usage of the npv function in microsoft excel.

Turn Spreadsheets Into Interactive Web Pages.

Free, easy returns on millions of items. Simplify big data analysis with gigasheet! This video also shows how to create a fv excel template for any future value problem. Web the future value of a dollar amount, commonly called the compounded value, involves the application of compound interest to a present value amount.

Web The Future Value (Fv) Function Calculates The Future Value Of An Investment Assuming Periodic, Constant Payments With A Constant Interest Rate.

Web future value (fv) = $100 × (1 + 10%) ^ 1 = $110.00; In the example shown, the formula in c7 is: Future value (fv) = $100 × (1 + 10. Web what is future value?

Web Financial Future Value Of Annuity Related Functions Summary To Get The Present Value Of An Annuity, You Can Use The Fv Function.

Ad instantly open files too big for excel and other spreadsheets. Web future value (c4): Returns the future value of an initial principal after. Web pv= fv / (1+r)^n where, pv = present value fv = future value r = interest rate per period in decimal form n = number of periods/years you plan to hold onto your.