Present Value Calculator Excel Template - Web present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. It is commonly used to evaluate whether a project or stock is worth investing in today. Net present value (npv) adds up the present values of all future cashflows to bring them to. Web download this template for free get support for this template table of content when somebody from financial institution come to you and offer some investment opportunities, usually they will hand you the table of the value of your money after some period of time. Net present value is the difference between pv of cash flows and pv of cash outflows. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Interest rate per payment period nper: Where n is the number of cash flows, and i is the interest or discount rate. Web the formula used for the calculation of present value is: Present value is discounted future cash flows.

Professional Net Present Value Calculator Excel Template Excel

The formula for npv is: In other words, $100 is the present value of $110 that are expected to be received in the future. Web and present value excel template provides such an easy way to calculate the values. Interest rate per payment period nper: Web if you want to calculate the present value of a single investment that earns.

Net Present Value Excel Template

Web present value and future value excel template updated: Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). Web download this template for free get support for this template table of content when somebody from financial institution come to you and offer some.

8 Npv Calculator Excel Template Excel Templates

Web = pv (rate, nper, pmt, [fv], [type]) where: Web present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). Web dividend retention ratio implied dividend growth.

Net Present Value Calculator Excel Template SampleTemplatess

Where n is the number of cash flows, and i is the interest or discount rate. Net present value (npv) adds up the present values of all future cashflows to bring them to. April 12, 2022 this time value of money excel template can help you to calculate the following: Present value future value fv of an annuity fva due.

Net Present Value Calculator Excel Templates

Net present value (npv) adds up the present values of all future cashflows to bring them to. Web formula examples calculator what is the present value formula? April 12, 2022 this time value of money excel template can help you to calculate the following: Web net present value template. Interest rate per payment period nper:

Net Present Value (NPV) with Excel YouTube

It is used to determine the profitability you derive from a project. Web = pv (rate, nper, pmt, [fv], [type]) where: Web the formula used for the calculation of present value is: Present value future value fv of an annuity fva due pv of an annuity pva due unequal. Web npv calculates that present value for each of the series.

Net Present Value Calculator Template Are you looking for a Net

Interest rate per payment period nper: Web if you want to calculate the present value of a single investment that earns a fixed interest rate, compounded over a specified number of periods, the formula for this is: In other words, $100 is the present value of $110 that are expected to be received in the future. We determine the discounting.

Net Present Value Calculator »

Calculate present value of an insurance Present value is discounted future cash flows. At the same time, you'll learn how to use the pv function in a formula. Payment per period (amount, including principal and interest) fv: April 12, 2022 this time value of money excel template can help you to calculate the following:

Professional Net Present Value Calculator Excel Template Excel TMP

This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web dividend retention ratio implied dividend growth rate what is present value? Web and present value excel template provides such an easy way to calculate the values. Present value is discounted future cash flows. Web calculates the net present value of.

How to calculate Present Value using Excel

Number of payment periods pmt: April 12, 2022 this time value of money excel template can help you to calculate the following: If left blank, value is. Web the net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Web present value and future value excel.

Syntax npv (rate,value1, [value2],.) the npv function syntax has the following arguments: The returned present value is negative as it represents outgoing payment. Where n is the number of cash flows, and i is the interest or discount rate. Payment per period (amount, including principal and interest) fv: =fv/ (1+rate)^nper where, fv is the future value of the investment; The formula for npv is: Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web the above formula gives this answer: It is commonly used to evaluate whether a project or stock is worth investing in today. Net present value is the difference between pv of cash flows and pv of cash outflows. Web the formula used for the calculation of present value is: It is used to determine the profitability you derive from a project. Web present value and future value excel template updated: If left blank, value is. The present value (pv) is an estimation of how much a future cash flow (or stream of cash flows) is worth right now. In other words, $100 is the present value of $110 that are expected to be received in the future. Web net present value template. While you can calculate pv in excel, you can also calculate net present value(npv). Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). We determine the discounting rate for the.

We Determine The Discounting Rate For The.

In other words, $100 is the present value of $110 that are expected to be received in the future. Web present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. April 12, 2022 this time value of money excel template can help you to calculate the following: Web microsoft excel already provide a tool to calculate this npv where you can use it directly.

And In This Spreadsheet, This Calculation Is Used To Compare Three Different Projects Or Investments Based On Discount Rate, Period, Initial Cash Flow And Yearly Cash Flow.

=fv/ (1+rate)^nper where, fv is the future value of the investment; Web if you want to calculate the present value of a single investment that earns a fixed interest rate, compounded over a specified number of periods, the formula for this is: The returned present value is negative as it represents outgoing payment. Web the above formula gives this answer:

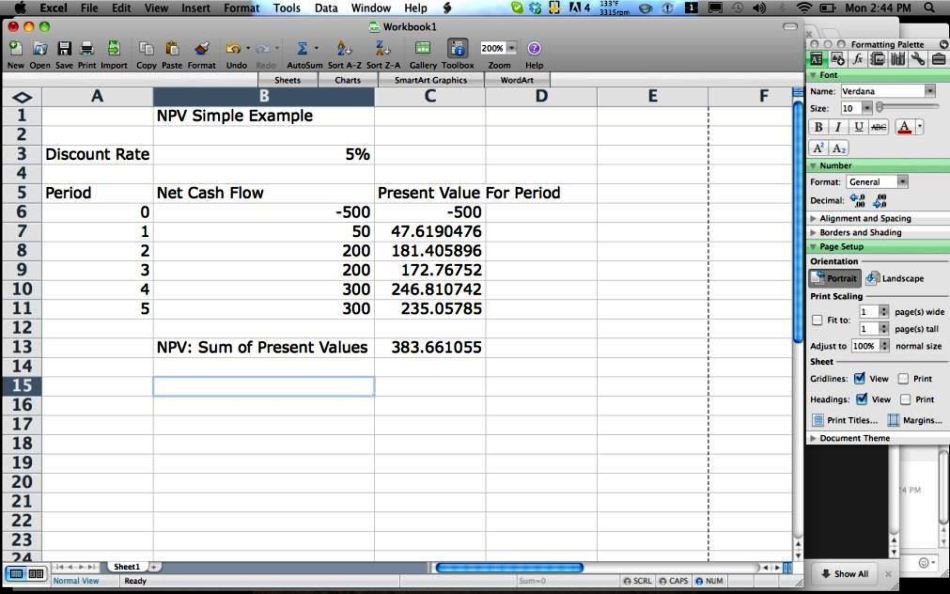

Here Is A Screenshot Of The Net Present Value Template:

Web dividend retention ratio implied dividend growth rate what is present value? The formula for npv is: If left blank, value is. Net present value is the difference between pv of cash flows and pv of cash outflows.

Payment Per Period (Amount, Including Principal And Interest) Fv:

Number of payment periods pmt: At the same time, you'll learn how to use the pv function in a formula. Web the net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values).